-

Login

More Login links

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Ways of banking More ways of banking links

Internet banking

Mobile banking

Telephone banking

Branches, ATMs and Post Offices

Useful information

Easy-peasy payments

Just a fingertip away with Apple Pay

Tap, pay, go.

Google Pay is here

- Current accounts More current account links

Our current accounts

Choosing an account

Managing your account

Our bank accounts

Find out more and compare our range of accounts

Your application

Log in to complete your online application and get your online decision

Need Help?

- Current account help

- Help and support home

- Credit cards More credit card links

Benefits of a credit card

Useful information

Need Help?

- Credit card help

- Help and support home

- Savings More savings links

- Loans More loan links

- Mortgages More mortgage links

New mortgage customers

Existing mortgage customers

Our mortgages

Tools and guides

Tools & calculators

Find out how much you could borrow, estimate monthly payments and request an Agreement in Principle

Start or continue an Agreement in PrincipleHow much could I borrow?Estimate mortgage repayments

Need Help?

- Mortgages help

- Help and support home

- Insurance More insurance links

- Personal Banking

- Ways of banking

- Current accounts

- Credit cards

- Savings

- Everyday Instant Access accounts

- Fixed term accounts

- Tax efficient savings

- Cash ISA APS

- Children's savings

- Interest Rates and Fees

- Terms and Conditions

- Financial Services Compensation Scheme

- Limited offers Hub

- Loans

- Mortgages

- Insurance

- Branch Locator

- Landing

- Coronavirus Information

Obtaining additional ISA allowances following the death of your spouse or civil partner

Introduction

Since 3 December 2014, where a person holding an ISA dies and that person was married or in a civil partnership, the surviving spouse/civil partner is entitled to an extra ISA allowance (even where the spouse/civil partner does not actually inherit the ISA). This is referred to as the Additional Permitted Subscription (APS) allowance.

This allowance may be used with the ISA provider of the deceased or an ISA provider chosen by the surviving spouse/civil partner. If the spouse/civil partner selects a different ISA provider, the allowance is passed to that ISA provider.

Broadly, the time limit for using the allowance is three years from date of death.

What is an Additional Permitted Subscription (APS) allowance?

This is an additional allowance independent of the normal annual ISA allowance.

This is not dependent on inheriting the actual money or investment in the deceased’s ISA. That follows the normal estate process. It is an allowance that equals the value of the ISA(s).

Where the deceased held multiple ISAs with different ISA providers there will be a separate APS allowance with each of the ISA providers.

The APS allowance is not something that can be transferred to another person; it is to be used solely by the spouse/civil partner of the deceased.

If there is no surviving spouse/civil partner there is no APS allowance.

The APS allowance does not apply to Junior ISAs or Child Trust Funds.

Who is eligible for an APS allowance?

Anyone whose spouse/civil partner died on or after the 3 December 2014 and at the date of death were:

- married or in a civil partnership;

- not legally separated or likely to become legally separated (If your spouse was in a care home this would not generally be considered as legally separated); and

- 16 years of age or over.

The availability of the APS allowance is not limited to UK residents. So customers who have moved abroad but whose spouse/civil partner still held an ISA(s) in the UK at the date of their death will be entitled to the APS allowance. In certain circumstances how they use the allowance will be limited by the fact they live abroad. Any questions or concerns over this should be directed to the ISA provider.

How is an APS allowance calculated?

This depends on the date of death of the deceased ISA investor.

Where the ISA investor died between 3 December 2014 and 5 April 2018 - The APS allowance equals the value of the ISA(s) at the date of death.

Where the ISA investor died on or after 6 April 2018 - Any ISA(s) held may remain open as a continuing account of a deceased investor, referred to here as a continuing ISA. The APS allowance equals the higher of the value of the ISA(s) at the date of death or the value of the ISA(s) at the date the ISA(s) cease(s) to be a continuing ISA.

The account will cease to be a continuing ISA on the earlier of the following:

- administration of the deceased’s estate is complete

- the ISA is closed

- 3 years after the date of death

Where multiple ISAs are held with one ISA provider, the value at the date of closure will be the total value of all ISAs at the date of closure of each account.

When the APS allowance is used, in whole or in part, the value of the APS allowance is fixed and cannot be changed.

How can I find out whether I have an APS allowance and how much it is?

Contact the deceased’s ISA provider(s) for information to ask what is needed for them to provide information about the APS allowance. In all instances the death must have been registered with the ISA provider(s) before they can supply information about the APS allowance.

What types of APS allowance subscriptions are possible?

APS allowance subscriptions, referred to here as payments, can be made to any type of ISA by using cash or by transfer of investments.

Restrictions on payments may apply depending on the type of ISA being used. Any questions should be referred to the ISA provider before an APS payment is made.

Payments made by cash - Payments can be made in cash to any type of ISA in the usual way, including by cheque or bank transfer, and do not have to be made using the money from the inherited ISA.

Payments made by transfer of investments - Payments can be made by the transfer of inherited investments which were held in the deceased spouse/civil partner’s ISA, to an ISA with the same ISA provider without selling the investments (an in specie transfer). The value of assets at the time the transfer is made counts towards the APS allowance limit. In specie transfers apply only to ISAs where investments may be held such as a Stocks & Shares ISA.

What time limits apply for using my APS allowance?

The APS allowance has been available since 6 April 2015. For APS allowance payments made in cash, the APS allowance is available for three years after the date of death, or for up to 180 days after administration of the estate is complete (i.e. when the personal representatives have distributed the assets of the estate), whichever is the later. This is known as the ‘permitted period’. For deaths between 3 December 2014 and 5 April 2015, the time limit began on 6 April 2015.

However the permitted period for APS allowance payments made in specie is within 180 days of beneficial ownership passing to the surviving spouse/civil partner. [For distributions between 3 December 2014 and 5 April 2015, the permitted period began on 6 April 2015.]

Where can I use my APS allowance?

The APS allowance may be used with the deceased’s ISA provider or another ISA provider.

Not all ISA providers will accept APS allowance subscriptions, but they are obliged to pass relevant APS allowance information on to another ISA provider.

How do I use my APS allowance?

ISA providers will require certain information from you (the spouse/civil partner) to open an ISA. They will also require an application form to use the APS allowance, which will typically include information such as:

- the deceased’s date of birth

- your National Insurance Number and that of the deceased (if known);

- the date of death;

- the date of marriage or civil partnership; and

- the deceased’s address at the date of death.

A declaration of eligibility for the APS allowance will be required and further declarations will be required every time an additional APS payment is made. Your ISA provider may ask you to provide additional documentation to open an account or to make an APS payment.

Some ISA providers will allow payments to be made in instalments whereas other ISA providers may require a lump sum payment.

If the lump sum payment is less than the total amount of the APS allowance then any remaining allowance will be lost.

The ISA provider can require that the APS allowance is used in a separate ISA or by topping up an existing ISA.

How do I use my APS allowance with another ISA provider?

You can transfer your APS allowance, subject to the other ISA provider agreeing to accept the transfer.

The new ISA provider should be approached to start the transfer and once started, ISA regulations require that this takes place within 30 days.

The APS allowance can only be transferred once, and only where no APS payments have been made.

APS allowances can be held with more than one ISA provider if the deceased held ISAs with more than one ISA provider.

Once I have made an APS payment can I transfer the ISA funds?

After an APS payment has been made, the cash and/or investments can be transferred to another ISA provider. If the APS allowance has not been fully used, and the original ISA provider allows payments in instalments, any further APS payments must be made to the original ISA provider before they can be transferred.

Where can I obtain further information?

The HMRC bereavement helpline team on 0300 200 3300 will be able to respond to any detailed queries about dealing with the APS allowance or the deceased’s estate.

The deceased spouse’s/civil partner’s ISA provider will be able to respond to any detailed queries about using the APS allowance.

- Personal Banking

- Ways of banking

- Current accounts

- Credit cards

- Savings

- Everyday Instant Access accounts

- Fixed term accounts

- Tax efficient savings

- Cash ISA APS

- Children's savings

- Interest Rates and Fees

- Terms and Conditions

- Financial Services Compensation Scheme

- Limited offers Hub

- Loans

- Mortgages

- Insurance

- Branch Locator

- Landing

- Coronavirus Information

You are here: Personal Banking > Savings > Tax efficient savings > Cash ISA APS

- About Clydesdale Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

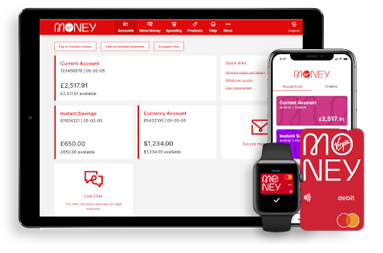

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

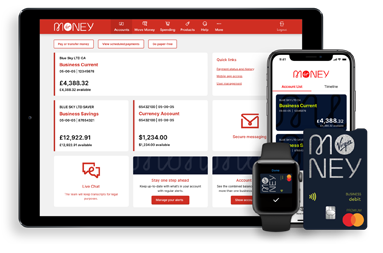

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Clydesdale Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.