-

Login

More Login links

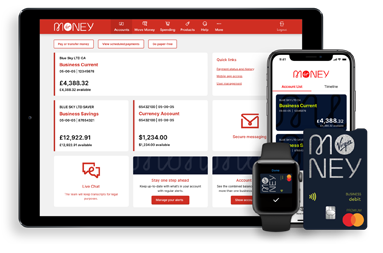

Internet Banking

Business Internet Banking

Started an application?

Other services

Help

-

Register

More Register links

Internet Banking

Business Internet Banking

Other Services

- Ways of banking More ways of banking links

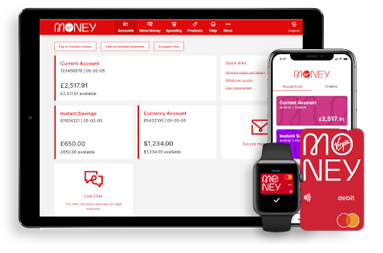

Internet banking

Mobile banking

Telephone banking

Branches, ATMs and Post Offices

Useful information

Easy-peasy payments

Just a fingertip away with Apple Pay

Tap, pay, go.

Google Pay is here

- Current accounts More current account links

Our current accounts

Choosing an account

Managing your account

Our bank accounts

Find out more and compare our range of accounts

Your application

Log in to complete your online application and get your online decision

Need Help?

- Current account help

- Help and support home

- Credit cards More credit card links

Benefits of a credit card

Useful information

Need Help?

- Credit card help

- Help and support home

- Savings More savings links

- Loans More loan links

- Mortgages More mortgage links

New mortgage customers

Existing mortgage customers

Our mortgages

Tools and guides

Tools & calculators

Find out how much you could borrow, estimate monthly payments and request an Agreement in Principle

Start or continue an Agreement in PrincipleHow much could I borrow?Estimate mortgage repayments

Need Help?

- Mortgages help

- Help and support home

- Insurance More insurance links

Current accounts

Our Clydesdale Bank current accounts section is getting a Virgin Money makeover

Get ready for a life more Virgin

Virgin Money teamed up with Clydesdale Bank back in October 2018. Since then, we’ve been working hard behind the scenes to bring the two banks together.

Our range of current accounts are now available under the Virgin Money brand, the perfect combination of expertise and Virgin innovation.

Existing customers

All our helpful information for existing current account customers can be found on Virgin Money.

Find out more about our helpful information for existing current account customers

Independent service quality

survey resultsPersonal Current Accounts - Published February 2024

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,000 customers of each of the 16 largest personal current account providers if they would recommend their provider to friends and family.

The results represent the view of customers who took part in the survey.

The full set of SQI results can be found here.

You are here: Personal Banking > Current accounts > Compare accounts

- About Clydesdale Bank

- About us

- Virgin Money UK PLC

- Media relations

- Careers

Internet Banking has moved

To log into Internet Banking you now need to use Virgin Money Internet Banking. You'll get the same great service and are able to access all your accounts.

Your log in details will stay the same and you can log in directly from the shiny new Virgin Money website.

Continue to Virgin Money Internet Banking

Go to the Virgin Money website

Be Alert

Never tell anyone a token 3 response code, even someone from the bank. You should only input these codes to our secure Business Internet Banking service when you’re sending and making payments. If anyone calls and asks for a token 3 response code or asks you to authorise a payment on the App for fraud checks, hang up and call us on 0800 085 2914 from another line if possible, remember the Bank will never ask you to disclose your security details.

Continue to Virgin Money Business Internet BankingYou can find impartial information and guidance on money matters on the “MoneyHelper” website.

Clydesdale Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.