Charity Term Deposit Account

We're no longer taking applications for the Charity Term Deposit Account on the Clydesdale Bank website.

Get ready for a life more Virgin

Virgin Money teamed up with Clydesdale Bank back in October 2018. Since then, we’ve been working hard behind the scenes to bring the two banks together.

From March 2021, our business banking range will be getting a Virgin Money makeover. You’ll start to see our new logo on things like statements and emails. Our website and digital services are getting the full Virgin Money treatment and we’ll begin to answer the phone as Virgin Money too.

Visit our Business Virgin Money Makeover page to see all the good things coming your way.

Make your charity’s money work even harder

Our range of charity savings accounts has something for organisations of all shapes and sizes.

Earn interest for your charity, by saving with one of our savings accounts.

Are you an existing customer?

There are no changes to your account information or login details, the only difference is that you will now sign in with the new Virgin Money Business Internet Banking service.

If you've banked with us for years or you've recently had a Virgin Money makeover, here's where you'll find your account information.

Frequently asked questions

I use the mobile app. Can I continue to use it?

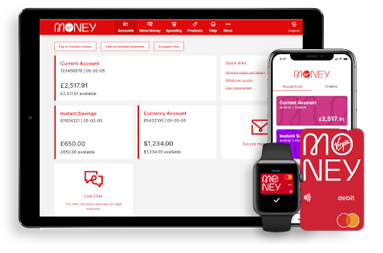

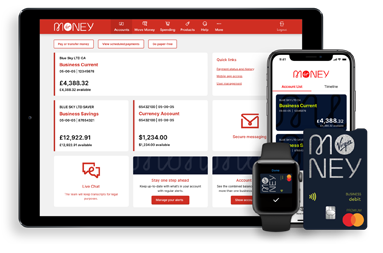

If you’re using the Clydesdale Bank app, you can now switch over to our Virgin Money mobile app in a matter of minutes with your existing passcode. Just download it and the Virgin Money app will show you what to do.

Can I still use Business Internet Banking?

You can now start using Virgin Money Business Internet Banking with the same sign in details as before. Everything you could do with Clydesdale Bank Business Internet Banking will still be there for you - but this time, you’ll get the iconic Virgin look and feel.

You can find impartial information and guidance on money matters on the “MoneyHelper” website.

Clydesdale Bank is covered by the Financial Services Compensation Scheme (FSCS), Find out more.